The past few years have seen a surge of FinTech business models that offer a wide range of financial services. The industry has grown in leaps and bounds owing to the rise in digital transactions and government investments in the drive for a cashless economy.

Of course, like most industries, the FinTech world was flipped on its head during the pandemic. While other markets crashed, FinTech, however, reported rapid growth as consumers started to rely heavily on virtual financial services to make payments and get deep financial or investment advice. The term ‘FinTech’ now covers a wide range of business models and use cases, including digital banking applications, payment gateways, asset management platforms, P2P lending, and digital wallets.

64% of consumers today have used one or more FinTech platforms (up from 33% in 2017), and 60% want to transact with financial institutions that provide a single platform, like a mobile banking app. To stand out in the crowd, FinTech leaders need a deep understanding of their clients’ financial profile and goals to create an exceptional user experience.

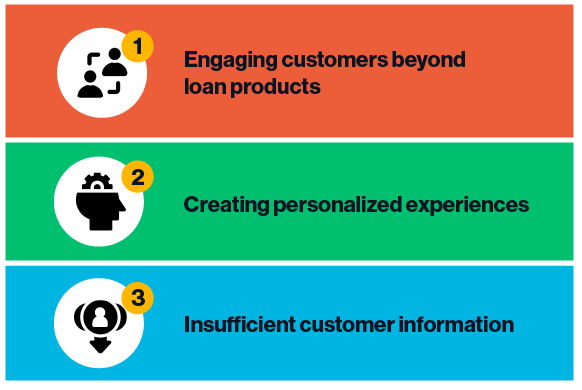

Today, the FinTech landscape has evolved beyond loan disbursements. Creating personalized sales cycles is crucial for generating key data points and using them to craft individual campaigns based on each customer’s unique needs. Of course, this is easier said than done, especially when there are plenty of challenges already facing FinTech brands.

Many FinTech brands find it difficult to engage customers beyond loan products and credit options, especially if those customers aren’t ready to sign up with a company for recurring subscriptions. Retaining customers has become a must-do activity for these brands, which includes having to branch out and offer new and competitive or complementary app features that go beyond traditional loan options. Some FinTech companies provide additional services, such as financial advice and accounting, that go beyond the features of the app or software to provide a more comprehensive experience for their customers.

Today’s consumers are all about speed, comfort, and ease of access. As such, many FinTech apps now also come with powerful features, such as easy document viewing, quick file transfers, and deep data capturing capabilities that can disburse loans in minutes or make lump-sum transfers in seconds.

These apps can be plugged in at every stage of the financial supply ecosystem. For example, something as simple as ‘AfterPay’ can make intuitive, easy transfers and payments at a moment’s notice. Companies like this allow post-purchase payments, which makes them accessible and coveted by people with low credit scores or those who have otherwise been a bad fit for traditional loans.

Creating a customer-first experience is crucial, but the difficulty lies in managing and maintaining complex customer records, such as banking history, credit scores, transaction activity, payment preferences, and financial goals. This makes it hard to build a complete picture of a customer before disbursing a loan or providing banking services. However, all of this can be monitored using a CRM for financial services or a customer data platform (CDP), which stores and updates this information based on their unique interests and needs.

In the FinTech world, brands are leveraging these powerful technologies to remain competitive, provide super-slick operations, and optimize their revenue. They can now predict customer needs and create personalized experiences through product recommendations and financial forecasting.

Financial services CRMs that are embedded with AI and ML allow brands to do these things:

Determine the risk from loan defaults through alternative credit scoring models

Automatically approve loans through integrated credit checks and pre-filled application forms

Verify the authenticity of know your customer (KYC) documents

Enhance the accuracy and personalization capabilities of financial services

Consumers are notoriously concerned about their data privacy, particularly when it comes to their financial information. This makes it hard for FinTech brands to create an omnichannel experience that merges all customer data touchpoints, simply because customers are too wary to provide them with data like their payment preferences, transaction history, and financial position.

As a result, brands might struggle with slow user adoption rates due to a lack of trust and that much-needed human connection (made even more difficult when brands encourage customers, who are used to in-personal experiences, to use a mobile-only bank).

Add to this the wealth of industry regulations and the red tape around using personal data; it can be hard to get the information needed from customers to provide a personalized experience. Companies are doing great things to tighten security aspects. One of the biggest challenges is understanding how and where data can be stored, and monitoring who has access to it. A financial services CRM provides a platform to securely store data and control who can and can’t see it.

While collecting user data is challenging, technology today makes it a lot easier to segment your audience into niche groups based on their interests, behavior, location, and other identifiers when you do have the information to go off on. Leverage this by sending out relevant recommendations sparked by what they are doing or how they engage with your business through an agile, easy-to-use CRM. AI embedded in a financial services CRM is constantly learning about customers and their preferences. Leveraging this capability can help brands fine-tune their customer’s journey based on those learnings.

One of the key challenges FinTech companies face digitally is meeting customer expectations. When a customer signs up for a checking account, it doesn’t stop there. Later down the line, they might need a mortgage, a car loan, or a credit card when they hit certain life stages. Providing recommendations at each new stage of the customer journey provides an opportunity for brands to deepen their relationship with customers by going beyond loan products.

It’s important for financial institutions to have a 360-degree shared view of their sales, services, and marketing teams so that relationship managers can visualize important milestones—buying a new home, preparing for a child’s college tuition, or planning for retirement.

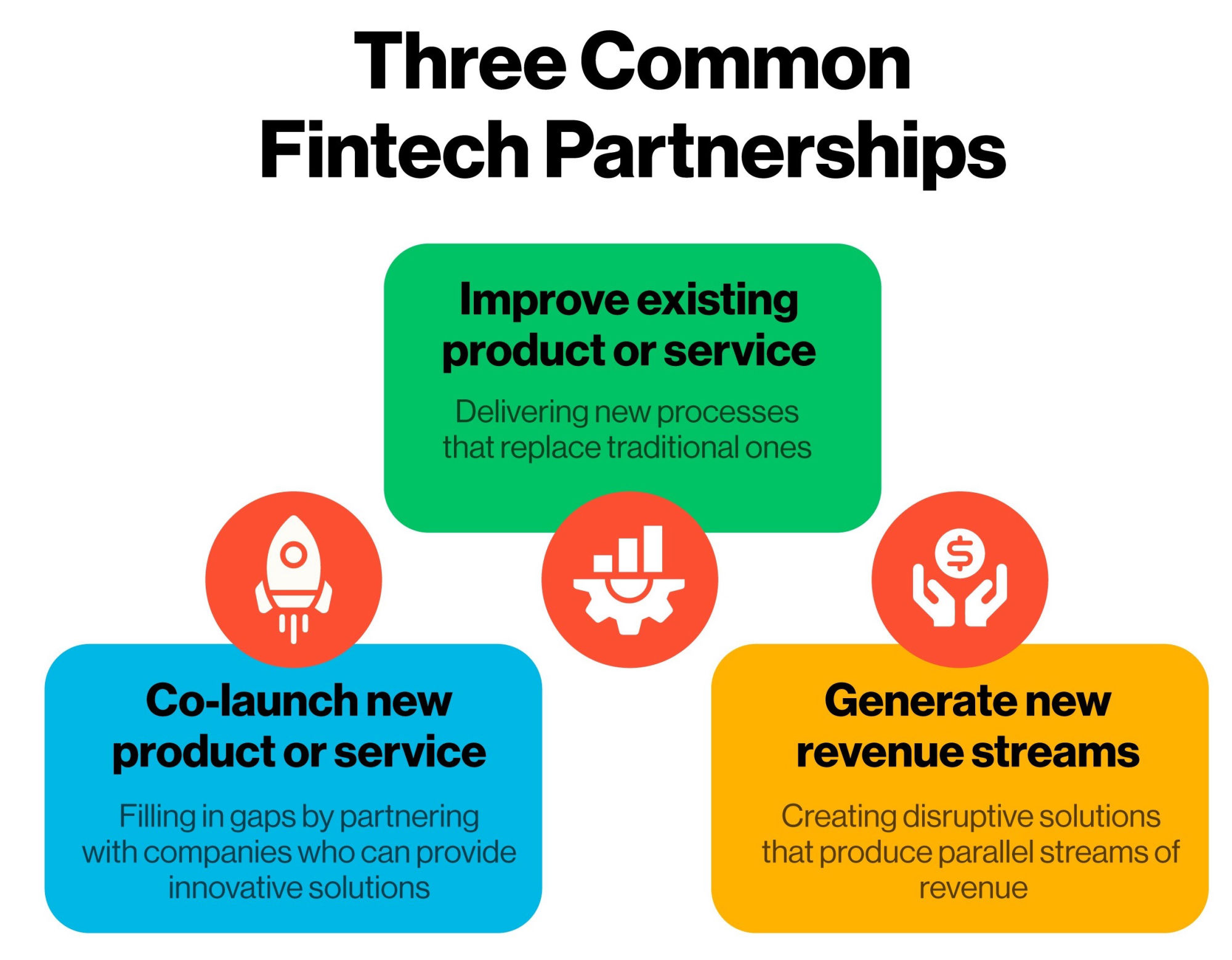

For FinTech companies, the most logical partnerships are with larger, traditional NBFCs or other financial institutions that can help them grow their list of wealth management services, supercharge growth, increase brand awareness, and acquire new customers.

The three most common partnerships in this respect are:

With a CRM for financial services, you can manage partnerships, store partner information, and communicate with them from one central place. The software can also track deal win and loss rates with your partner through powerful customized dashboards along with partner portals for easy collaboration.

If you’re thinking about venturing into strategic financial partnerships, ask yourself:

What kind of customer base will I acquire with this partnership?

Is this partnership going to help me achieve my vision for revenue growth?

How will I aim to address any potential security risks?

How will the ease of use in accessing credit and loans change for my current set of clients if I decide to partner with this brand?

Productivity optimization is key for FinTech brands that want to maintain a competitive edge. Fail to respond quickly enough to a client and you might lose them forever. Instead, take corrective action by storing deal information and daily activities, such as discovery calls, notes, meetings, and tasks, without leaving the CRM.

On top of this, a financial services CRM can simplify document collection and automate multi-level approval processes where both clients and advisors can see the status of loan approvals, card upgrades, and other key banking services, even while being on the go if they come with a user-friendly mobile instance.

CRMs also streamline cash collection, which can help track service status, identify priorities, and enable borrower-specific repayment strategies that increase engagement and tie into unique customer needs.

The four action points above are some of the major ways we’ll see technology shaking up the FinTech world in the coming months and years. For emerging FinTech players, the ground is still fresh and new, which makes it easy to enter the market with a competitive edge. There are two key things to note here:

A shift from product-centric to customer-centric financial services: Companies will need to hone their applications to make them easily accessible for customers without compromising on data security. Key activities like loan processing or asset management can be effectively managed by agents who are well equipped to provide financial advice and asset rebalancing through a well-implemented financial services CRM that uses AI and data-based algorithms.

New consumer markets: Through FinTech applications, companies are expanding into untapped regions or micro-credit societies where traditional banking was a huge hassle. This opens up a huge opportunity for growth marketing in places like Asia and South America, and further creates a ripple effect for other related companies to invest in these regions—thanks to the rise of mobile payments and digital credit systems.

The pandemic had a huge impact on the FinTech industry. An increasing number of people turned to digital payments, wallets, and banking options under stay-at-home orders, but consumers today still crave a personal connection and a replica of the in-person banking experience. To recreate this, FinTech companies need to have a deeper understanding of consumers’ financial data points, which can then be used to create bespoke customer journeys and experiences.

Sorry, our deep-dive didn’t help. Please try a different search term.