INDUSTRY

Financial Services

LOCATION

USA

10,000

hours saved with AI chatbots

1.4M

conversations per quarter

60%

reduction in agent training time

About the customer

This Freshchat customer is one of the largest credit card companies in the world that enables over 57 million cardholders to spend smarter, manage debt better, and save more for a brighter financial future.

Their core values and emphasis on customer service give voice to their customer obsession and their drive to constantly discover new ways to provide effortless experiences. Over the years, the company has built a reputation for outstanding customer service, having won highly acclaimed awards in the finance space.

Moving to a modern customer messaging platform

This Finserv customer keeps customer service at the front and center of their offering by employing over 8000 customer service agents located across the continental US and available 24x7. These agents handle queries on phone and digital channels.

Their first foray into digital customer service was in 2006 when they launched live chat support on the website. Although live chat was well received by their customers, their Director of Digital Customer Service and the team felt they could do even better.

“Our goal is to provide an effortless customer service experience to our consumers. We do this by servicing them in their channels of preference. If they have an issue, they can call our customer center telephone line. If they don’t want to call, they have the option to message us.”

Customers would go to the website, click on the ‘Chat with us’ option, and wait in a chat queue hoping an agent is available. They could not switch tabs or leave the page as this would mean missing their turn in the queue and having to start over. If the agent was able to resolve a query, a feedback survey would be sent, marking an abrupt end to the customer service experience.

The team sought to improve this experience with a flow that was familiar and intuitive, similar to texting on iMessage, WhatsApp, and other messaging applications. They wanted to adopt a contextual and continuous messaging approach.

Winning with Freshchat

This Finserv company assembled a team to scout for a new partner that will help them to not only scale but to also deliver cutting edge customer experiences.

“We evaluated around 20-30 live chat providers to partner with for the next 5 to 10 years in our CX journey before choosing Freshchat.”

During their evaluation, they wanted improvements from three perspectives - the customer, the agent, and the business.

Delivering intuitive customer experiences

This Finserv company’s legacy live chat solution restricted chat to purely website support. In addition to this, using session-based live chat meant that conversation history would be lost after each session and agents would be unable to access any information that had been provided to them.

With Freshchat, this leading credit card provider upgraded from live chat to modern messaging not only on their website but also on their mobile app using Freshchat's robust mobile SDK. They also extended their customer service on iMessage using Freshchat's native integration with Apple Business Chat.

Customers are now able to shift from web support to mobile support seamlessly without having to restart their conversations. The continuous messaging style of Freshchat allows agents to maintain the context of past issues the customer has faced and lets them provide a personalized experience.

“Messaging is different from legacy live chat. It’s like friends and family. It’s persistent and it is forever. Customers are moving into these channels of preference to engage with brands - Apple Business Chat, WhatsApp, Facebook Messenger, or within our mobile app. Customers have told us, this is like having customer service in their pockets, all the messaging history and context is there - it’s persistent and familiar.”

Improving the agent experience

This Finserv company’s evaluation team was convinced that a solid agent platform was one of the most important factors in selecting a messaging partner. According to them, customers are not the only end-users, but also the 8,000 member support team who use the platform every day to create moments of delight.

They wanted to give their agents a familiar and intuitive interface that would allow them to focus their energy on the customer, and not on complex, clunky software.

“Our agents are using Gmail, Twitter, Facebook in their personal lives - but enterprise chat platforms have these complex and complicated interfaces that make it challenging and difficult. We needed a tool that our agents would be comfortable with and enjoy using. Freshchat was a clear winner here!”

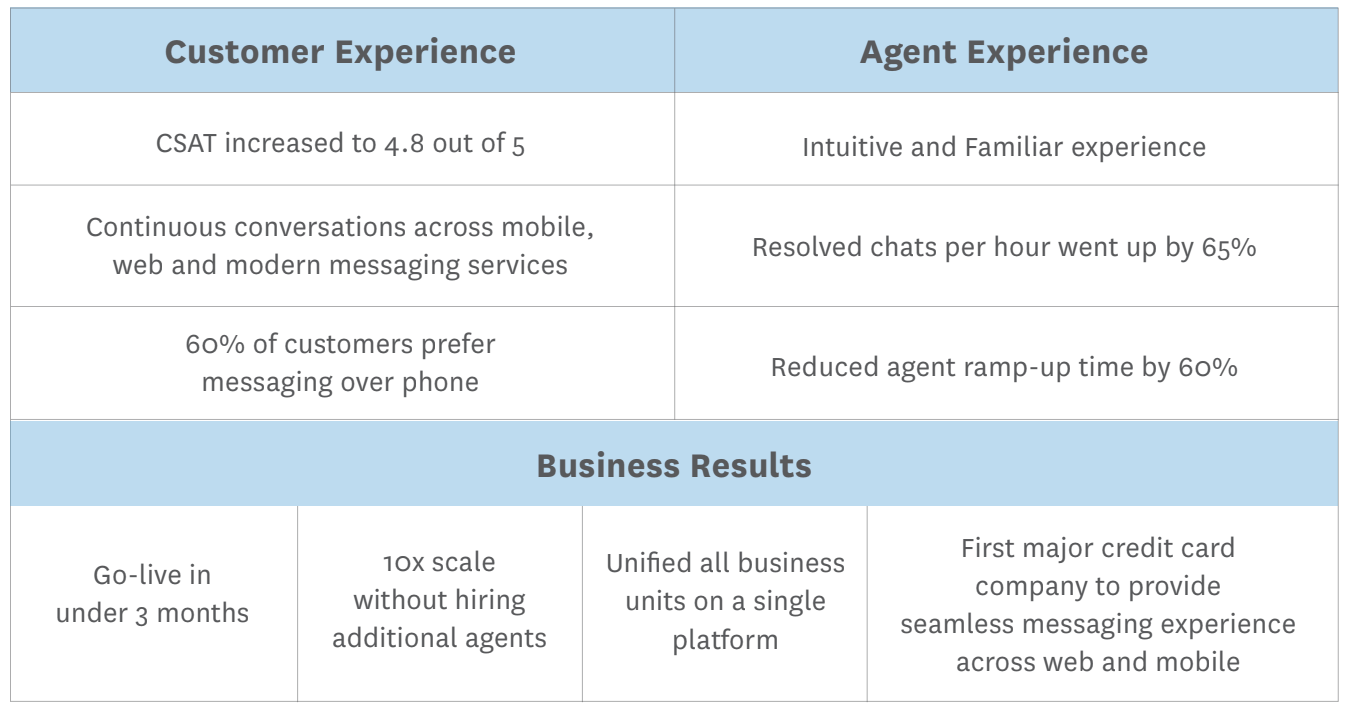

Freshchat’s modern messaging experience made it easy for the agents straight away. With an interface similar to popular messaging applications like Facebook Messenger & WhatsApp, the learning curve was minimal. To put a number on it, agent training time was reduced by as much as 60%. Agents felt less stressed about using Freshchat’s agent interface and were in turn able to provide a better messaging experience to the end user.

Decluttering the enterprise

With the earlier legacy live chat solution, this leading US credit card provider was not able to bring all their business units (BU) under a single chat instance. The live chat widget was not customizable enough to match different brand styles and websites for each business group. More importantly, there was no way to limit access to customer information for different agent groups and maintain data confidentiality between business units. This was not an ideal situation as different BUs were operating in silos without a seamless flow of customer context.

With Freshchat’s advanced roles and permissions feature, this Finserv company unified all their teams under a single Freshchat instance. Now, everyone has context while key customer information is still protected by retaining the right access controls for the right teams. With Roles and Permissions, they were able to create custom roles with very granular access permissions.

"Freshchat not only offered the breadth of features that were critical but also the depth and granularity to make it work for our enterprise requirements."

Scaling with bots and AI

Due to the scale of their operations, this Finserv company felt that being able to bring their own customer-facing chatbots was a critical requirement. Freshchat’s open APIs allow them to build their own customer-facing chatbot and fetch information from other internal systems.

They receive a wide range of customer queries, some of which are easier to respond to than others. A simple question like “What’s my account balance?” requires an agent to switch screens, login to an internal system, retrieve the account information, and paste it back in the chat. This process takes around 3 minutes. With Freshchat, the platform makes an API call to fetch the account information and provides instant responses to customers without human intervention.

Implementing their Virtual Assistant has had a significant impact already, saving over 10,000 hours of valuable agent time. The leverage bots to solve as many customer enquiries in as little time as possible.

“Freshchat’s flexible APIs let us bring our own automation experience. We have employed our Virtual Assistant to respond to simple questions. We have a confidence scoring system and if the questions are too complex for the bot to answer, it seamlessly transfers the conversation to a human agent with the context and history for a more emotive conversation. This transfer is extremely seamless in that the customer has to perform no action at all - it all happens in the same chat window for them”

Tangible Results

Incorporating Freshchat on their website and mobile app resulted in improved CSAT, a rise in agent productivity, and a significant increase in messaging volumes.

- This Finserv company is recognized as the first major credit card company to provide a seamless customer experience across the web and mobile.

- CSAT went up to 4.8/5 from 4.6/5 within a year of implementing Freshchat. At the scale of 1.4 million resolved conversations just in the third quarter of 2019, this represents a significant improvement in chat performance.

- Resolved chats per hour per agent has steadily gone up 65% since the beginning of the year.

- They managed to scale chat volumes 10x without having to increase the agent count at all thanks to bots and AI.

The road ahead

In order to learn about consumer preferences, this leading credit card provider enabled the ‘click to chat’ feature on iOS. When a customer tries to call their customer service telephone line, they are prompted to choose between ‘Call’ and ‘Message Us’. 60% of customers chose to message rather than call.

The preference for messaging also presents a great opportunity for this leading Finserv company to improve agent productivity. A customer service agent is able to handle 5-6 concurrent chats in the same amount of time as it would take them to resolve one phone call. They believe they can do 50% better in terms of agent productivity as messaging as a channel matures further.

"In the true sense, Freshchat lets us provide an uninterrupted messaging experience at all times. Well, we’ve had 10x growth after introducing messaging and over 60% of our customers prefer messaging to reach out to us.”

The writing is on the wall for enterprise brands. Customers are moving away fromtraditional channels like phone and legacy live chat. They prefer to use messaging that is user-friendly, familiar and available - be it Facebook Messenger, Apple Business Chat or WhatsApp.

This leading US Finserv company wins customers-for-life with Freshchat, one conversation at a time. You can take that to the bank!